Tesla has experienced remarkable stock performance over the past five years with a total return of 1,300%. This incredible growth reflects company’s expansion in the electric vehicle market, tech advancements, and increased revenue. Fintechzoom tesla Stock gives you all the latest news and information here.

Platform provides minute by minute information on Tesla stock that offers insights into market trends, price changes, and detailed analysis. It serves as a valuable resource for investors looking to track its performance, news, and financial metrics.

What Is Tesla Stock?

Tesla stock represents a part of Tesla, Inc., a global leader in electric vehicles and clean energy solutions. The intial public offering (IPO) was in July 2010 and the stock became available on Nasdaq global market.

Anyone who buys TESLA stock owns a piece of the company. Stock price fluctuates daily and is driven by several factors. Investors get excited about the innovative products and potential for future growth. Many consider Tesla stock as a long-term investment because of the company’s growing market share in the electric vehicle industry.

Tesla stock is publicly traded and listed on NASDAQ under the ticker symbol TSLA. Those buying shares in Tesla bet on the company’s ability to maintain dominance in its industry and continue its rapid growth.

Overview and History of Tesla, Inc

Tesla, Inc. was founded in July 2003 by Martin Eberhard and Marc Tarpenning. The company’s mission was to accelerate the world’s transition to sustainable energy. Elon Musk joined Tesla’s board of directors in February 2004 and led an initial round of investment and became the company’s largest investor.

In early 2006, Tesla unveiled its first car, the Roadster, a high-performance electric sports car that showcased the potential of electric vehicles (EVs). The Roadster’s success helped establish Tesla as a leader in the EV market.

TSLA began trading on the stock market in July 2010, with an initial public offering (IPO) price set at $17 per share. Over the years, the stock has seen significant growth. Tesla stock doubled in value in its first year. In 2020, prices reached over $226.75 per share as growth continued.

Stock prices soared after major milestones like the Model S, Model 3, and the expansion into renewable energy. Tesla’s 5-for-1 stock split in August 2020 was a key moment. That move made shares more affordable for individual investors and allowed TESLA to attract a larger group of buyers. Throughout its history, TESLA has experienced both rapid growth and volatile moments..

Relationship Between Fintechzoom and Tesla Stock

You know fintechzoom provides a platform for investors to analyze and monitor Tesla stock. There are detailed charts, real-time stock prices, and market insights available. Platform serves as a resource hub that gives investors the chance to learn and understand market trends.

You can stay informed about the latest stock movements and see projections based on current data. It simplifies tracking Tesla stock for everyone. Its ease of use benefits individuals looking to trade or invest. The fintechzoom tsla stock analysis is simple for both beginners and experts.

Why You Should Invest in Tesla Stock in 2024?

Tesla stock attracts investors for several reasons. First, the company sits at the forefront of the electric vehicle revolution. Tesla plays a leading role in the shift towards more sustainable energy options worldwide. Their innovative technology sets them apart from competitors. The stock reflects that growth potential.

Next, TESLA has shown impressive financial performance over time. A loyal customer base, rapid growth, and innovative products have driven share prices higher. Tesla stock may offer long-term investment opportunities that predict further dominance in electric vehicles and energy.

Finally, Tesla’s leadership team adds confidence for investors. With Elon Musk as CEO, many believe in his vision and ability to lead the company toward further success.

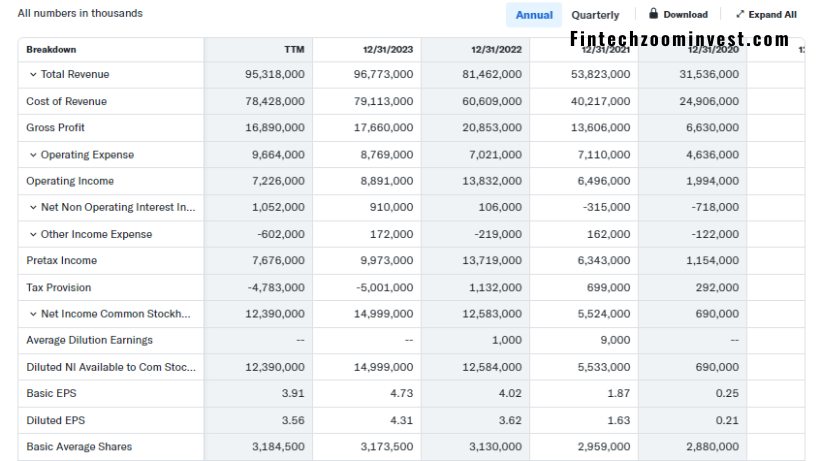

Historical Performance of Tesla Stock

TESLA’s IPO price in 2010 started at $17 per share. The stock surged after the Model S was released that reached $14.83 in 2014. New product releases caused prices to rise steadily over the next few years. In August 2020, the 5-for-1 stock split made shares more accessible.

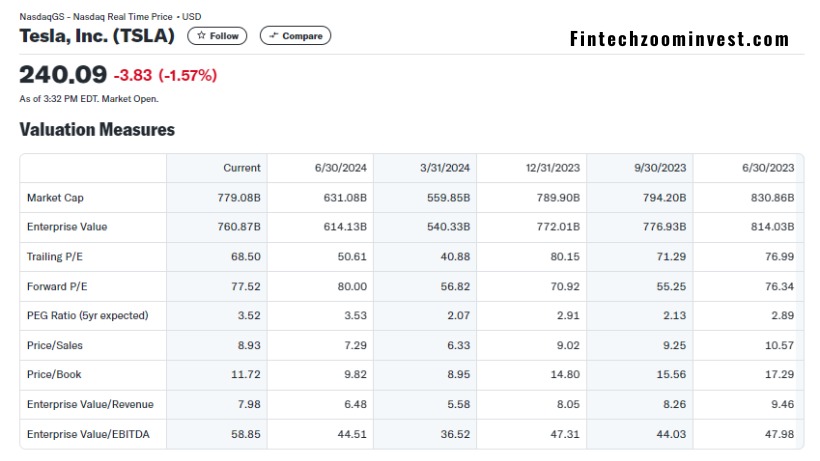

Tesla’s stock traded over $2,000 at the time of the split. Prices continued to rise after the split. TESLA’s market capitalization now exceeds $800 billion making it one of the largest companies globally. Over the years, key milestones like new factory openings and expanding energy solutions kept driving the stock upwards. TESLA’s historical price trends show both moments of high growth and occasional pullbacks.

1. Price Chart

| Year | Stock Price (Closing) |

| 2015 | $16 |

| 2016 | $14.24 |

| 2017 | $20.76 |

| 2018 | $22.19 |

| 2019 | $27.89 |

| 2020 | $235.22 |

| 2021 | $352.26 |

| 2022 | $123.18 |

| 2023 | $248.48 |

| 2024 | $238.36 |

2. Increasing Competition in 2024

Tesla faces stronger competition from both legacy automakers and new entrants into the EV market. Companies like Ford and General Motors have ramped up their electric vehicle production posing a challenge to Tesla’s market dominance.

Meanwhile, newer brands like Rivian, Lucid Motors, and fintechzoom muln stock have gained traction with their innovative EV models, further intensifying the competition.

Despite these challenges, Tesla maintains a competitive edge through its extensive charging infrastructure, autonomous driving capabilities, and brand loyalty. However, investors are keeping a close watch on how Tesla manages this increasing competition.

3. Dividend and Return on Investment (ROI)

Tesla does not currently pay dividends to shareholders. The company focuses on reinvesting profits back into growth, research, and product development. Tsla stock may not appeal to investors who are looking for regular dividend income. However, the return on investment (ROI) has been significant.

Many early investors who bought shares in 2010 saw over 1000% returns by 2020. Their ROI reflects the company’s rapid expansion and leadership in the electric vehicle market. Investors count on future growth rather than short-term payouts.

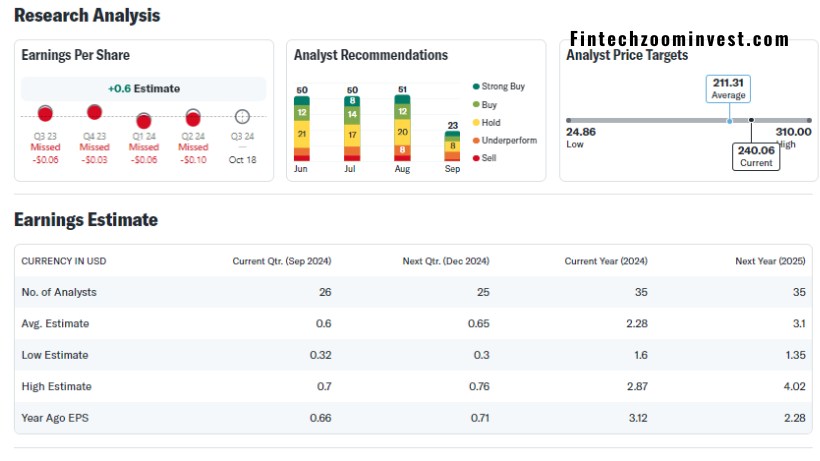

Tesla Stock Prediction for 2025 and 2030

According to 24/7 Wall St, 50 different Analysts predict the consensus of 12-month price target between $204 – $290 in 2025. It can be a reduction of 10% in the price. Some believe that continued innovation and expansion into new markets could drive prices higher. Others feel that the stock may face challenges due to growing competition and market saturation.

According to the Manager of Baron Focused Growth Fund, Tesla stock prediction 2030 could reach $1200. That will be 550% increase in the upcoming 5 years.

Forecasts show potential for long-term growth, but risks remain. Investors need to stay informed, monitor trends, and be aware of broader market conditions.

Risks Involved in Fintechzoom Tesla Stock

Investing in Tesla stock comes with certain risks. Stock price volatility is one of the key concerns. Prices can change rapidly based on company news, market trends, or economic factors.

Additionally, competition in the electric vehicle market poses a challenge. Tesla’s dominance may diminish as more automakers enter the market. Stock performance is also affected by changes in government policies, interest rates, and inflation.

The use of FintechZoom helps investors mitigate some risks by providing up-to-date information, enabling them to track and adjust their strategies more easily. Here is a list of Fintechzoom Best Stocks to Invest in 2024.

Key Factors Influencing Stock in 2024

- Stock Price Trends: Monitor Tesla’s fluctuating stock price throughout the year.

- Technological Developments: Keep an eye out for updates on energy storage and autonomous driving.

- Competition: Track the arrival of new players and established automakers in the EV market.

- Market Conditions: Stay informed about inflation, interest rates, and global economic factors affecting Tesla’s stock.

How to Use FintechZoom for Tesla Stock Analysis?

FintechZoom offers a comprehensive suite of tools for analyzing Tesla stock. Check real-time price data and historical trends first. You can spot patterns and movements in prices by using charting features.

FintechZoom also includes forecasts, company financial reports, and expert opinions. These resources help you make informed decisions. Set price alerts to stay updated on any significant movements.

How to Buy Tesla Stock Using Fintechzoom and Other Brokerages?

- Use FintechZoom to analyze Tesla stock (TSLA).

- Open an account with a brokerage (e.g., Robinhood, E-Trade, Charles Schwab).

- Deposit funds into your brokerage account.

- Search for Tesla stock using the ticker symbol “TSLA.”

- Choose between a market order (buy at current price) or a limit order (set your price).

- Place the order to buy shares.

- Monitor your investment in FintechZoom for price updates and trends.

Experts Opinions on Tesla Stock

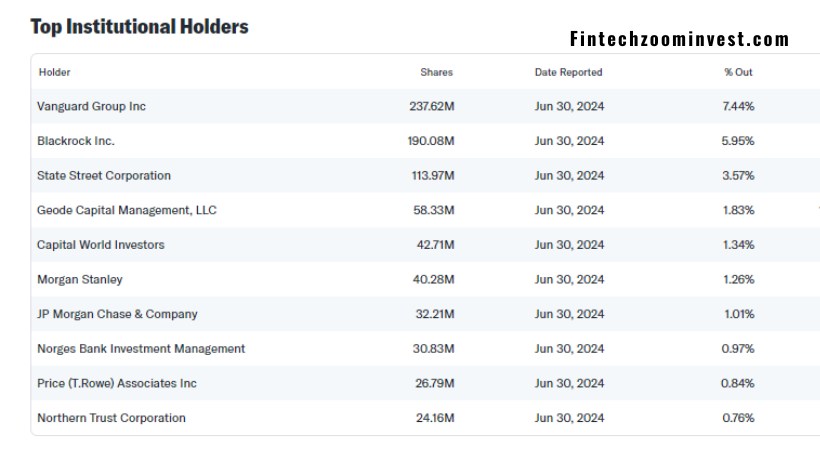

Experts offer diverse opinions about TESLA stock. Some see it as a strong long-term investment, citing the company’s leadership and growth potential. Others remain cautious, pointing out risks related to competition, high valuation, and global economic uncertainty.

Many agree that TESLA’s future hinges on its ability to innovate and maintain its market position. Those with a high-risk tolerance may find TESLA stock appealing.

Learn about AMD Stock Fintechzoom to get more options for your portfolio.

Tips for New Investors

- Start small: Investing in stocks can be risky, especially with volatile stocks like TESLA. Begin with a small investment to understand how the stock performs over time. You can always add more shares later as you become more comfortable.

- Research is key: Understand the basics of the stock market before buying any stock. Research TESLA’s financials, market position, and future growth prospects. Check how it compares with competitors and other sectors to get a holistic view.

- Diversify your portfolio: Don’t put all your money into one stock, even if you’re confident in TESLA’s potential. Diversifying your investments across different industries and companies helps lower your risk if one stock underperforms.

- Set long-term goals: TESLA stock can be volatile in the short term. Consider holding your shares for the long term, especially if you believe in the company’s vision. Trying to make quick profits from stock price swings can be risky.

- Monitor the news: Keep up with news related to TESLA and the overall market. Economic trends, new government policies on electric vehicles, and innovations in the industry can impact TESLA’s stock price.

- Avoid emotional decisions: Stock prices can fluctuate daily. Don’t panic if prices drop suddenly, and don’t rush to buy more when prices rise quickly. Stick to your research and long-term goals.

Common Tips to Avoid

- Chasing quick profits: Trying to get rich quickly by jumping on trending stocks often leads to disappointment. Instead, focus on long-term growth and avoid buying shares based on hype.

- Ignoring research: Don’t invest in a company just because others are doing so. Always research a company’s financial health, market trends, and future growth potential before committing money.

- Investing without a plan: Going into the stock market without a strategy can lead to impulsive decisions. Decide how much you’re willing to invest, how long you’ll hold the stock, and when to sell before you make your first purchase.

- Over-investing in one stock: Even if you’re confident in TESLA’s future, putting all your money into one stock is risky. Diversification across industries and markets helps protect against potential losses.

- Trying to time the market: Many new investors make the mistake of trying to buy at the lowest point and sell at the highest. Timing the market is extremely difficult, even for seasoned investors. Instead, focus on consistent investing and long-term goals.

Wrapping Up

Fintechzoom Tesla stock offers both opportunities and risks for investors. Its leadership in the electric vehicle market, focus on innovation, and strong brand make it a compelling investment. However, its high valuation, competition, and potential economic challenges are factors to consider.

People Also Ask

Is TESLA stock a good investment in 2024?

Some experts believe TESLA remains a good long-term investment due to its leadership in electric vehicles and innovation. However, others caution about its high valuation and growing competition.

How does TESLA compare to competitors like Ford and Rivian?

TESLA leads in electric vehicle sales and innovation, but competitors like Ford and Rivian are catching up. Ford offers more affordable stock, and Rivian targets a niche market with electric trucks and SUVs.

What are the risks of investing in TESLA stock?

Key risks include stock price volatility, competition from other automakers, and broader economic factors like inflation and interest rates.